30+ mortgage deduction california

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Answer Simple Questions About Your Life And We Do The Rest.

. Homeowners who bought houses before. Web California Rules For Mortgage Interest Deduction In the state of California they use the same value that is on an individuals federal tax return. File With Confidence Today.

Find out which credits and deductions you can take. Ad Filing Taxes Is Fast And Easy With TurboTax Free Edition. Web California is one of the few states to require deductions for disability insurance.

Web The state has nine tax brackets as of the 2022 tax year. Web California does not allow a deduction for mortgage insurance premiums. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Gifts by Cash or Check Qualified Charitable Contributions Your California deduction may be different. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web 30-Year Mortgage Rates 15-Year Mortgage Rates 51 Arm Mortgage Rates 71 Arm Mortgage Rates Lender Reviews Quicken Loans Mortgage Review Rocket.

California real property owners can claim a 7000 exemption on their primary residence. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. However in general you can deduct any mortgage interest that you pay on up to 750000 of debt.

However higher limitations 1 million 500000 if married. This may seem like a drag but having disability insurance is a good idea to protect yourself and. See If You Qualify Today.

Thats 264 higher than the 52-week low of 449. Web TurboTax will automatically use the larger of the California itemized deductions - which are different from federal - or the California standard deduction. This reduces the assessed value by 7000.

Web Above 109000 54500 if married and filing separately you cant make any deductions for mortgage insurance. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Californias top individual income tax rate is 123 on annual incomes over 677275 for single.

Web What you can deduct depends on your particular financial circumstances. Web Most homeowners can deduct all of their mortgage interest. Web What Credits and Deductions Do I Qualify for.

Web According to the Tax Cuts and Jobs Act of 2017 taxpayers may deduct up to 750000 in home loan interest for homes purchased as of December 16th 2017. Deductions Standard Itemized. Web Up to 96 cash back Theres a 2 cap on this.

Web 6 hours agoTodays average interest rate on a 30-year fixed-rate jumbo mortgage is 713 the same as last week. Between those two incomes you can deduct.

Californians Home Mortgage Deduction Would Be Capped Under New Bill

Kailash Yogesh Co Chartered Accountants Noida

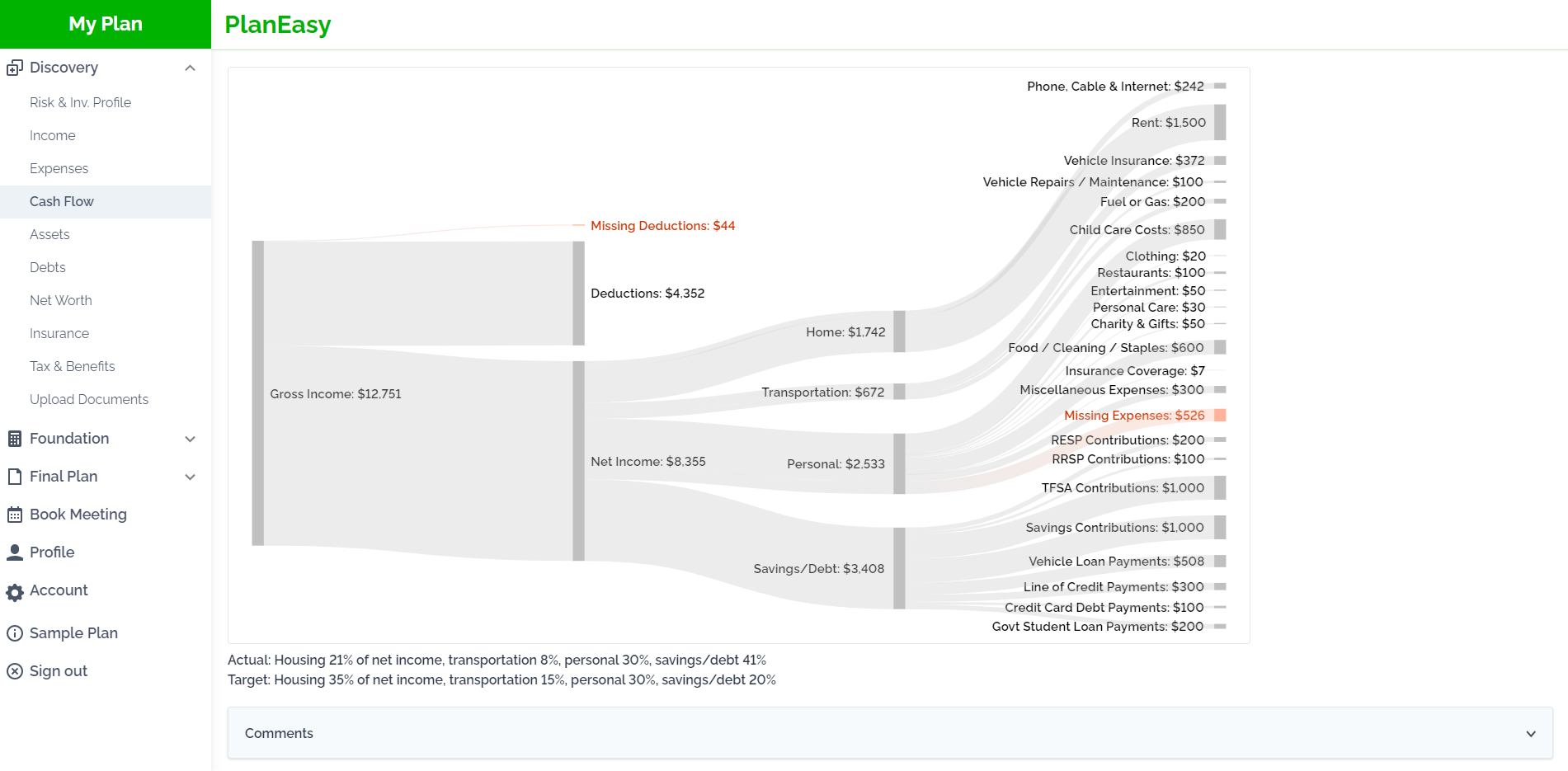

Introducing Self Directed Financial Planning Planeasy

Mapped The Salary You Need To Buy A Home In 50 U S Cities R Dataisbeautiful

Mortgage Lender Woes Wolf Street

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Draft Exam Practice Kit For Ca Professional Level Tax Planning Compliance Covering Finance Act 201 By Saiful Islam Mozumder Issuu

Majority Of Homeowners And Renters Benefiting From The Tax Cuts And Jobs Act John Burns Real Estate Consulting

Mortgage Interest Tax Deduction Smartasset Com

The Mid Tier Correction In California Housing A Burbank California Shadow Inventory Three Times The Size Of Non Distressed Mls Inventory Dr Housing Bubble Blog

Designing For Multilingual Translation Digital Benefits Hub

Will The New Tax Law Affect My Mortgage Interest Deduction San Diego Mortgage Broker San Diego Home Loans

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

2009 Comprehensive Annual Financial Report Calpers On Line

Streamlining Snap For The Gig Economy Digital Benefits Hub

Student Loan Debt Statistics In 2018 A 1 5 Trillion Crisis

Prices Of Existing Homes Fall 11 From Peak Sales Hit Lockdown Low Cash Buyers And Investors Pull Back Hard Wolf Street